If you have ever checked mutual fund returns, SIP performance, stock analysis or long-term investment reports, then you’ve probably seen one common term everywhere — CAGR. This is very powerful term in finance.

But what exactly is CAGR? Why is it used so widely in investing? And how does it help you understand your portfolio’s performance better than simple returns?

In this article, I’ll break CAGR down in the simplest way possible to help you understand— with examples, formulas, real numbers and scenarios you can relate to. By the end, you’ll understand exactly how to use CAGR in your investment journey. After that if you have any more doubts then you can comment or mail me personally. So let’s start…

Why CAGR Matters in Investing

Investing is not just about how much profit you make — it’s about how consistently your investment grows over time.

Beginners look at simple returns like:

- “I made an investment of ₹1,00,000 and it grew to ₹2,00,000 in 5 years — that means I got 100% return.”

- “This stock doubled in value in just 1 year; it must be a great investment.”

But this doesn’t tell you the full story.

You need to know the rate at which your investment grew every year on average, and that’s where CAGR comes in.

CAGR tells you:

- how stable your investment growth is,

- what returns you are actually getting every year,

- and how your investment compares to others.

In short, CAGR helps you judge performance more accurately.

What is CAGR?

CAGR = Compound Annual Growth Rate

It tells you the average yearly growth rate of your investment over a specific period — assuming the investment grows at a steady, compounding rate.

In simple words:

CAGR tells you how much your investment grew per year, as if it grew at the same rate every year.

Of course, real investments never grow in a straight line. But CAGR helps you simplify and compare.

Let’s simplify this with real-life examples.

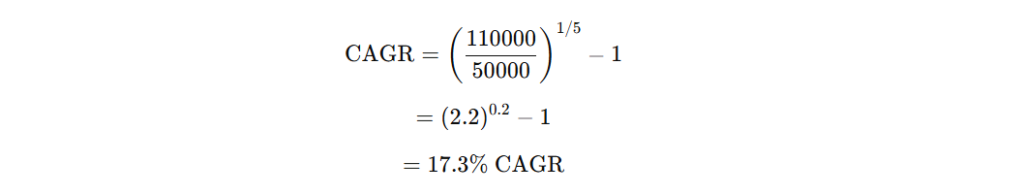

Real-Life Example 1 — Stock Investment

Imagine you invested:

- ₹50,000 in Tata Motors in 2020

- Its value becomes ₹1,10,000 in 2025

Total value doubled, but what is the actual yearly growth rate?

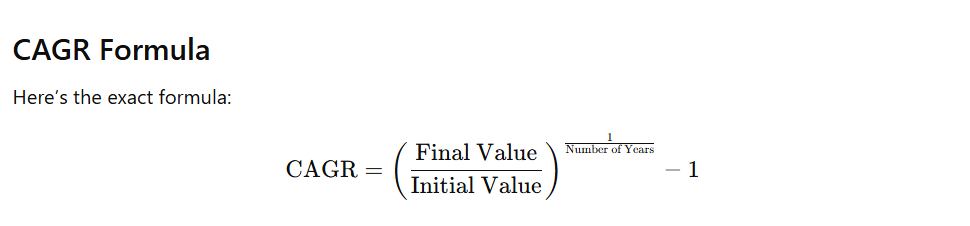

Use the formula:

So you’re not getting “double returns.”

You’re actually getting 17.3% every year, on average.

This is much more meaningful as it tells you exactly how much your investment gave you in 5 years. Many gets confused in such scenarios, hopefully you will not after learning this.

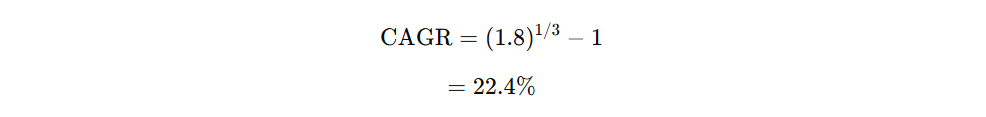

Real-Life Example 2 — Mutual Fund Return

Suppose your mutual fund grew:

- From ₹1,00,000 to ₹1,80,000

- In 3 years

Calculate CAGR:

Your mutual fund earned 22.4% per year, not “80% overall.”

Why CAGR is Better Than Simple Returns

Let’s say you have two friends, who invest ₹1,00,000 each in a fund.

Friend A (A smooth performing fund)

Year 1 → 10%

Year 2 → 12%

Year 3 → 14%

Friend B (A volatile fund)

Year 1 → +30%

Year 2 → –20%

Year 3 → +40%

Both might show similar total returns, but which one is safer?

CAGR helps you understand:

- How consistent the returns are

- How well the investment compounded

- Which investment is riskier or more reliable

CAGR smooths the volatility and gives a clear picture.

Why Investors Should Care About CAGR

Here’s why CAGR is extremely useful:

✔ Helps compare different investments

Stocks vs. mutual funds vs. fixed deposits — all become comparable.

✔ Shows long-term performance

Short-term returns often lie. CAGR focuses on long-term compounding.

✔ Used in all investment platforms

Groww, Zerodha, Moneycontrol, INDmoney, Kuvera — all show CAGR.

✔ Helps in setting financial goals

If you want ₹50 lakhs in 15 years, CAGR tells you what rate of return you need.

✔ Helps eliminate “noise”

Daily or monthly market fluctuations don’t matter. CAGR looks at the big picture.

How to Calculate CAGR Quickly (No Math Required)

If you don’t want to calculate manually, use:

- Groww CAGR Calculator

- Zerodha Varsity CAGR Tool

- Moneycontrol

- INDmoney

- Google CAGR Calculator

You simply enter:

Initial Amount → Final Amount → Time Period → CAGR appears automatically

So even beginners can easily calculate it.

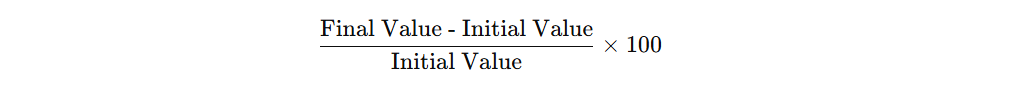

Difference Between CAGR and Absolute Return

Absolute Return

Example: Your ₹1,00,000 becomes ₹1,50,000

Absolute return = 50%

CAGR

“On average, how much return did you get per year?”

Example:

₹1,00,000 → ₹1,50,000 in 5 years

CAGR ≈ 8.4%

Which one gives more clarity?

👉 CAGR, because it shows the yearly performance.

Real-Life Example 3 — Comparing Two Stocks

Stock A:

- ₹1,00,000 → ₹2,00,000 in 4 years

- CAGR = 18.9%

Stock B:

- ₹1,00,000 → ₹2,50,000 in 6 years

- CAGR = 16.0%

Even though Stock B gives higher absolute profit,

Stock A performs better yearly.

This is why professional investors rely on CAGR.

CAGR in SIP — Does It Work?

Many investors get confused — “Does CAGR apply to SIP?”

Not exactly.

For SIPs, a better metric is:

XIRR (Extended Internal Rate of Return)

because SIP involves multiple monthly investments.

But mutual fund platforms still show 1-year, 3-year, 5-year CAGR of the fund, not your personal returns.

CAGR shows how the fund grew, not your SIP profit.

Where CAGR Falls Short (Its Limitations)

Although CAGR is extremely useful, it has some limitations:

❌ Assumes stable growth

Real investments fluctuate; CAGR smooths everything.

❌ Doesn’t show volatility or risk

Two investments may have the same CAGR but very different risk levels.

❌ Not useful for SIPs or uneven cash flows

For that, XIRR is better.

❌ Doesn’t predict future performance

Historical CAGR ≠ guaranteed future returns.

Still, CAGR gives the clearest picture of historical performance.

Real-Life Example 4 — House Price Growth

You bought a house:

- in 2010 for ₹40 lakhs

- in 2024 it’s worth ₹1.2 crore

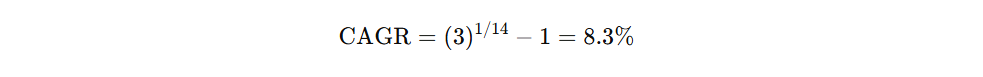

Calculate CAGR:

Even though the property tripled in value, the annual growth is 8.3%, not “200%.”

This helps compare real estate with stock market returns.

Real-Life Example 5 — Your Salary Growth

CAGR applies to salaries too.

Example:

- Starting Salary: ₹4,00,000 per year

- After 5 years: ₹9,00,000

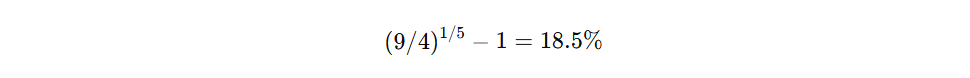

CAGR formula:

Your salary grew at 18.5% per year — a very healthy growth rate.

So CAGR is useful in personal finance too — not just investments.

How to Use CAGR in Your Investing Journey

Here’s how beginners can make the most of it:

✔ Compare mutual funds

Choose funds with higher and consistent 5-year or 10-year CAGR.

✔ Compare stocks

Check long-term return consistency.

✔ Set investment targets

If you want ₹1 crore in 20 years, you need a target CAGR of around 12%.

✔ Measure portfolio performance

Don’t judge based on short-term movements — look at CAGR.

✔ Avoid being misled by high short-term returns

Just because a stock rose 50% recently doesn’t mean it’s good long-term.

What is a Good CAGR?

It depends on the investment type:

| Investment Type | Good CAGR Range |

|---|---|

| Fixed Deposit | 5–7% |

| Debt Mutual Funds | 6–9% |

| Index Funds | 10–13% |

| Large-Cap Stocks | 10–15% |

| Mid-Caps | 15–20% |

| Small-Caps | 18–25%+ |

Long-term, the Indian stock market delivers around 12–14% CAGR historically.

CAGR vs XIRR vs IRR — Quick Summary

| Metric | Used For | Suitable When |

|---|---|---|

| CAGR | Average annual growth | Single investment with start + end value |

| XIRR | Return on SIP or staggered investments | Different amounts invested at different times |

| IRR | Project returns | Cash flows vary regularly |

For most beginners, CAGR + XIRR is enough to understand returns well.

Final Verdict — Why CAGR Should Be Your Go-To Metric

CAGR simplifies the most complicated investing concept — long-term growth.

It gives you:

- clarity

- consistency

- and a fair way to compare different investments

Whether you’re analyzing stocks, mutual funds, real estate, or even your salary growth —

CAGR is the cleanest, most reliable measure of performance.

If you truly want to invest smartly and grow your wealth, start paying attention to CAGR, not just profits or “percentage up.”

It’s one number that can change the way you look at investing forever.

Read More: Why Most People Lose Money in the Stock Market — 10 Common Mistakes

Pingback: ICICI Prudential IPO Explained: Key Details, GMP & Risks - The EquityVerse