Why I Chose Godrej Consumer Products for Financial Modeling

When learning financial modeling, selecting the right company is extremely important. A good company should have a strong business model, consistent financial performance, clear growth opportunities, and enough publicly available data to build realistic assumptions.

I chose Godrej Consumer Products Limited (GCPL) because it perfectly fits these criteria. It is one of India’s leading Fast-Moving Consumer Goods (FMCG) companies with a strong presence not only in India but also in several international markets such as Africa, Indonesia, and Latin America.

FMCG companies are often considered stable investments because people continue to buy everyday products regardless of economic conditions. Items like soap, hair color, household insecticides, and personal care products are part of daily life, making demand relatively predictable.

While building this financial model, my main goal was to understand how analysts evaluate a company, estimate future growth, calculate intrinsic value, and ultimately decide whether the stock looks attractive from an investment perspective.

Image Source: IndianRetailerCom

In this article, I will walk you through:

- A simple overview of the company

- The industry outlook

- Demand and supply dynamics

- Future growth potential

- Key insights from my financial model

- Risks investors should consider

- Mistakes I made while building the model

- My final investment view

You will also find my Excel financial model if you comment on my post then I will surely provide you which you can use as a learning resource if you are interested in financial analysis.

Who Should Read This Article?

This article is especially useful for:

- MBA students learning finance

- Beginners in financial modeling

- Stock market enthusiasts

- Anyone interested in equity research

- Students preparing for careers in investment banking or research

I have intentionally kept the language simple so that even readers with basic finance knowledge can understand the concepts easily.

Company Overview

Godrej Consumer Products Limited is part of the well-known Godrej Group, a business conglomerate with a long-standing reputation in India. Over the years, the company has built a strong brand identity and consumer trust.

GCPL focuses mainly on household and personal care products. Some of its major product categories include:

- Hair color

- Soaps

- Household insecticides

- Air fresheners

- Liquid detergents

- Personal wash products

Image Source: RepublicWorld

One of the biggest strengths of the company is its diversified geographic presence. While India remains a key market, GCPL generates a significant portion of its revenue from international operations. This reduces dependence on a single economy and spreads risk.

Another notable feature is the company’s asset-light approach in certain markets and its focus on innovation. By regularly launching new products and improving existing ones, GCPL manages to stay relevant in a highly competitive industry.

From an investor’s perspective, companies with strong brands often enjoy pricing power. This means they can pass on some cost increases to consumers without losing demand — a major advantage during inflationary periods.

Understanding the FMCG Industry

Before building a financial model, it is essential to understand the industry in which the company operates.

The FMCG sector is known for:

- High sales volume

- Low product cost

- Frequent purchases

- Strong distribution networks

- Brand-driven competition

In India, rising income levels, urbanization, and increased awareness about hygiene and personal care have significantly boosted FMCG demand.

Additionally, rural consumption has emerged as a powerful growth driver. As infrastructure improves and digital penetration increases, companies can reach customers in previously untapped markets.

Another positive factor is the shift toward premium products. Consumers today are willing to pay more for quality, convenience, and better experiences.

However, the industry is not without challenges. Companies face pressure from:

- Rising raw material costs

- Intense competition

- Changing consumer preferences

- Supply chain disruptions

Despite these risks, the FMCG sector is generally considered defensive, meaning it tends to perform better than cyclical sectors during economic slowdowns.

Demand and Supply Dynamics

Understanding demand and supply helps analysts forecast revenue growth more accurately.

Demand Drivers

Several factors continue to support demand for GCPL’s products:

1. Population Growth

A growing population naturally leads to higher consumption of everyday goods.

2. Increasing Disposable Income

As people earn more, they spend more on branded and premium products.

3. Urbanization

Urban consumers often prefer packaged and branded goods due to convenience.

4. Hygiene Awareness

Post-pandemic behavior has increased focus on cleanliness and health.

5. Product Innovation

New product launches attract customers and encourage repeat purchases.

Image Source: Trendlyne

Supply Factors

On the supply side, companies must manage:

- Raw material procurement

- Manufacturing efficiency

- Logistics

- Distribution networks

Any disruption in these areas can impact margins.

For example, if palm oil prices rise sharply, soap manufacturers may see cost pressures.

Therefore, while projecting future margins in my financial model, I considered the possibility of moderate cost fluctuations rather than assuming perfectly stable expenses.

Future of the Sector

The long-term outlook for the FMCG sector in India appears positive.

Here are some trends likely to shape the future:

Premiumization

Consumers are upgrading from basic products to higher-quality options. This improves profit margins for companies.

Digital Distribution

E-commerce platforms are becoming important sales channels, allowing companies to reach customers directly.

Rural Expansion

Improving rural infrastructure is opening new markets.

Sustainability Focus

Consumers increasingly prefer environmentally responsible brands.

Data-Driven Marketing

Companies now use analytics to understand customer behavior and design targeted campaigns.

Given these trends, companies that invest in innovation, branding, and distribution are likely to outperform.

GCPL appears well-positioned to benefit from many of these structural changes.

Key Insights From My Financial Model

The financial model was built using historical financial data, reasonable growth assumptions (totally sample based), and margin projections (mostly calculated on average).

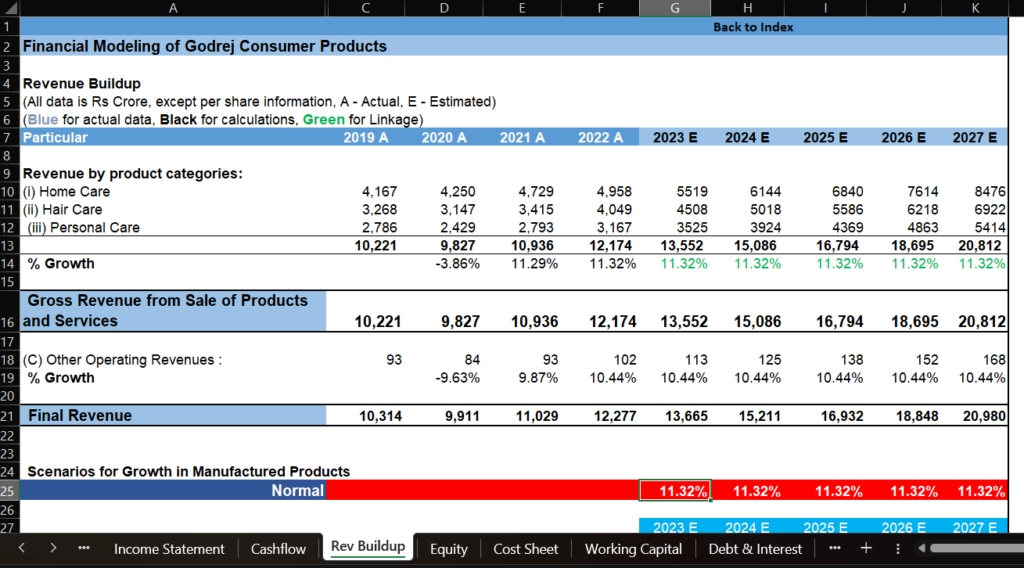

Revenue Growth Assumptions

Instead of assuming extremely high growth, I used a balanced approach based on:

- Industry growth trends

- Past company performance

- Last 4-5 years average

This resulted in steady projected revenue growth rather than unrealistic spikes.

Margin Expectations

Margins were assumed to improve gradually due to:

- Premium product mix

- Operating leverage

- Better cost management

- Averaging of last 4-5 years

However, I avoided overly optimistic assumptions to keep the model realistic.

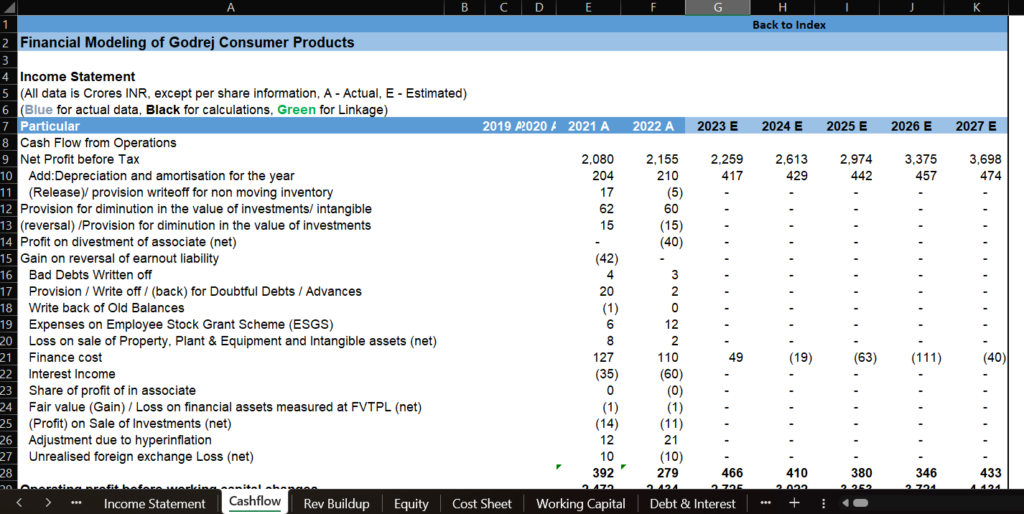

Cash Flow Strength

One of the most encouraging observations was the company’s ability to generate operating cash flows.

Strong cash flow supports:

- Business expansion

- Debt reduction

- Dividend payments

Cash flows were created through multiple more pages which have their own relevance as if you won’t create those then you can’t get to create a realistic cash flow.

Debt Position

Companies with manageable debt levels generally carry lower financial risk.

While analyzing the balance sheet, I ensured that future projections did not rely heavily on excessive borrowing. It was also created through other important multiple sheets like cash flows.

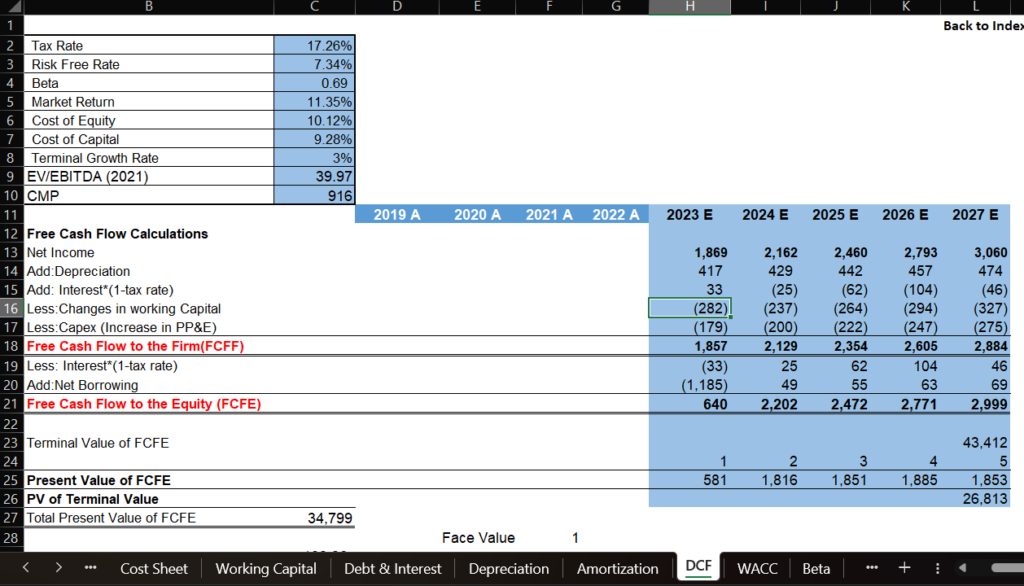

Valuation Approach

To estimate intrinsic value, I used the Discounted Cash Flow (DCF) method.

DCF calculates the present value of expected future cash flows.

Key inputs included:

- Free cash flows to firm

- Free cash flows to equity

- Discount rate

- Terminal growth rate

DCF is the most difficult part and it require more data and more linked important sheets in MS Excel.

Risks Investors Should Consider

No investment is risk-free. Identifying risks is just as important as identifying opportunities.

Some major risks include:

1. Commodity Price Volatility

Rising input costs can pressure margins.

2. Currency Fluctuations

International revenue exposes the company to exchange rate movements.

3. Competitive Pressure

Losing market share could slow growth.

4. Execution Risk

Expansion strategies must be implemented effectively.

5. Economic Slowdowns

Although FMCG is defensive, premium product demand may weaken during severe downturns.

Being aware of these risks leads to more balanced investment decisions.

Mistakes I Made While Building This Model

Financial modeling is a learning process, and mistakes are part of improvement.

Here are a few errors I initially made:

1. Overestimating Growth

At first, I assumed aggressive revenue growth. After reviewing industry data, I revised it to more sustainable levels.

2. Terminal Growth Assumptions

Choosing an unrealistic terminal growth rate can distort valuation. I used formulas and normal rate which i googled as I am not a pro.

3. Learning Outcome

These corrections made the model more practical and closer to real-world analysis.

If you are building your own model, remember that realism is more valuable than optimism.

Final Verdict – Would I Consider Investing?

Based on my analysis, the company demonstrates many qualities associated with stable long-term businesses:

- Strong brand equity

- Consistent demand

- Healthy cash generation

- Global diversification

However, valuation ultimately determines investment attractiveness.

Even great companies may not be good investments if purchased at excessively high prices.

Therefore, investors should compare intrinsic value with the current market price before making decisions.

From a long-term perspective, businesses with durable competitive advantages and steady growth often reward patient investors.

As far as I am concerned “YES” I invested based on the model. I got good returns as my investment lasted more then 1.5 years. After that I found a better stock so I shifted it to another. I do believe in my financial model as I got good returns to follow. you must trust what you have build.

Read More: The “Rate Cut” Waiting Game: What to Do with Your Cash

Pingback: Aye Finance IPO Date, GMP, Price Range, Profit - The EquityVerse